Launching Amazon Pay with Chase: Scaling Multi-Billion Dollar Product Suite

Chase aimed to grow in the buy-now-pay-later (BNPL) space. To support this, I led service design to align cross-functional teams and launch Amazon Pay with Chase. I also led product design to ensure a seamless customer experience that integrated smoothly with the existing pay-over-time suite. I organized the products to match customer mental models while working within current tech and design system constraints.

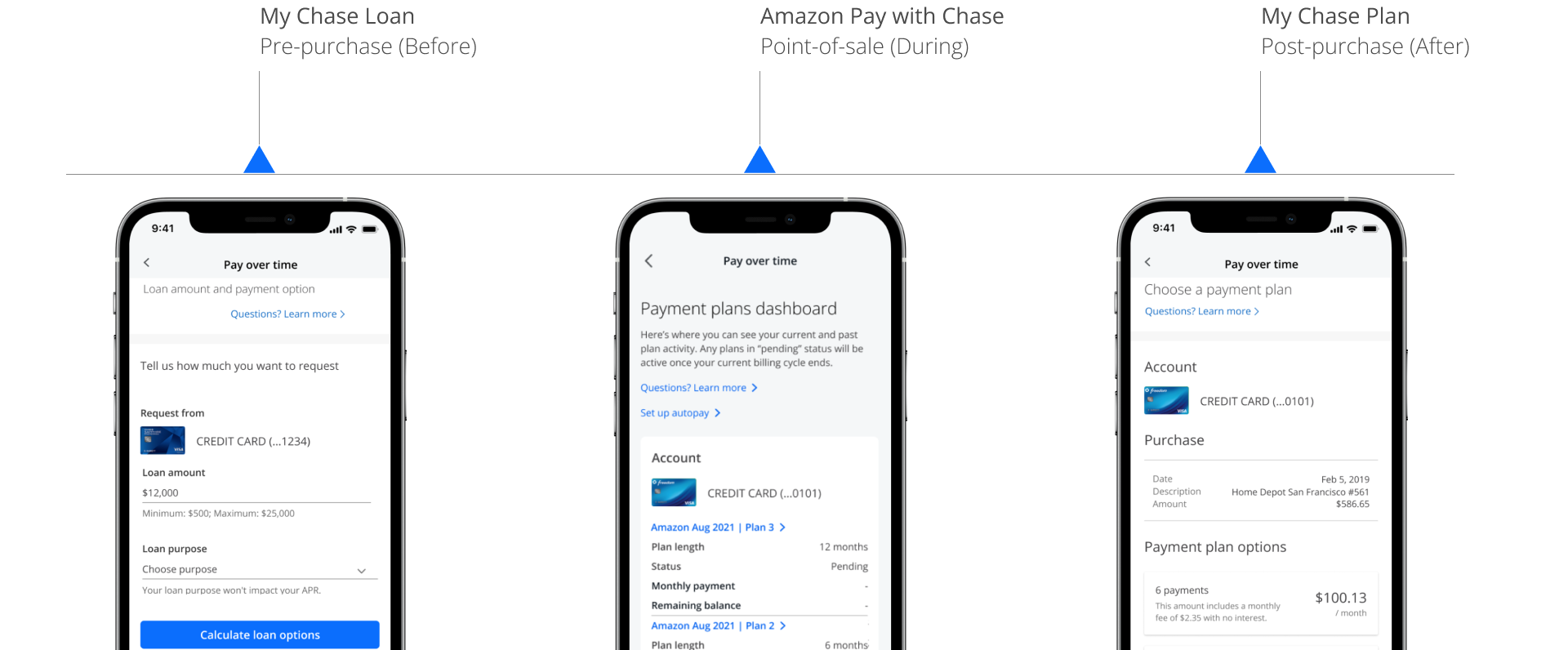

Chase Pay Over Time is a suite of buy-now-pay-later products that gives credit card customers flexible payment options throughout the purchase journey. The suite includes My Chase Loan (MCL), Amazon Pay with Chase, and My Chase Plan (MCP). In 2022, MCL and MCP served 1.2 million customers and generated nearly $4 billion in loan volume. Additionally, MCP won Real Simple magazine's Smart Money Awards for Best Financial App & Services.

My role

Given the scale and complexity of the business goal, I took on a broad range of responsibilities that spanned strategy, execution, and cross-functional leadership. These responsibilities fall into three categories:

Purpose

Outcomes & Impacts

I led the end-to-end UX for three interconnected products, ensuring each met distinct user needs while contributing to a cohesive product suite. I drove consistency across experiences by aligning design patterns, interactions, and messaging. I scaled design by building frameworks and reusable components, enabling faster iteration and reducing duplication. I also evangelized the value of UX by connecting design decisions to business outcomes, driving stakeholder alignment and buy-in.

People

Influence & Collaboration

I worked autonomously to identify opportunities, define problems, and push solutions forward. Within the design team, I mentored peers, shared feedback, and helped set quality standards. I partnered closely with product, engineering, legal, compliance, and data teams to ensure viability, feasibility, compliance, and value across product suite. I also influenced senior leaders by framing design trade-offs, aligning on priorities, and advocating for customers at every stage.

Practice

Discovery & Delivery

Responsible for both discovery and delivery, I conducted research, synthesized insights, and mapped customer journeys to inform strategy and define product requirements. I translated those requirements into clear, usable, high-fidelity prototypes and ADA compliant design specifications for mobile and web experiences. I facilitated large workshops to levelset goals, align stakeholders and rapidly iterate, ensuring designs were both thoughtful and executable within technical, regulatory, and resource constraints.

Challenge

It was an exciting time. To compete with fintechs like Klarna and PayPal and traditional banks like Citi with Citi Flex Pay, Chase was partnering with Amazon to launch its first point-of-sale buy-now pay-later (BNPL) product. This product is now named Amazon Pay with Chase.

This high-stakes partnership aimed to achieve market parity and unlock future opportunities with major brands like United and Southwest airlines. A successful launch was critical to Chase’s growth in the BNPL space. However, three major roadblocks threatened the success of the launch.

⚠️

Cross-functional teams were siloed and misaligned on dependencies — leading to delays and inefficiencies.

⚠️

Customers must move from Amazon to Chase to manage product — resulting in a disjointed experience and confusion.

⚠️

New product lacked cohesion with existing offerings — making it difficult for customers to navigate and understand their options.

🕵️♂️

Discovery

The challenge spread across people, products, and platforms. To tackle this systemic challenge, I applied a mix of design and system thinkings, and product and service designs. Through targeted discovery activities, I clarified the problems, defined their scopes, aligned stakeholders, and fostered collaboration to unlock effective scalable solutions.

Silos caused inefficiencies and delays

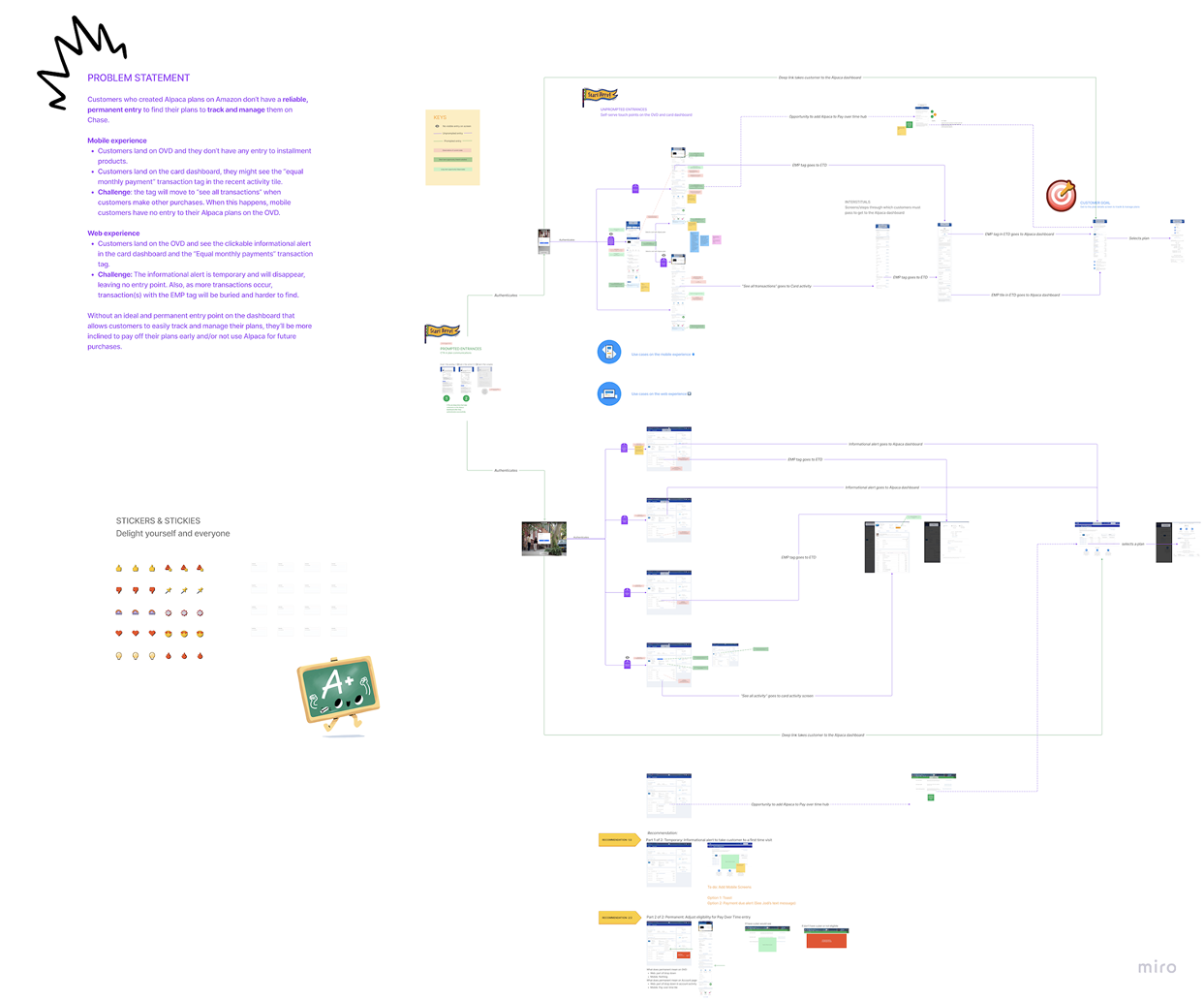

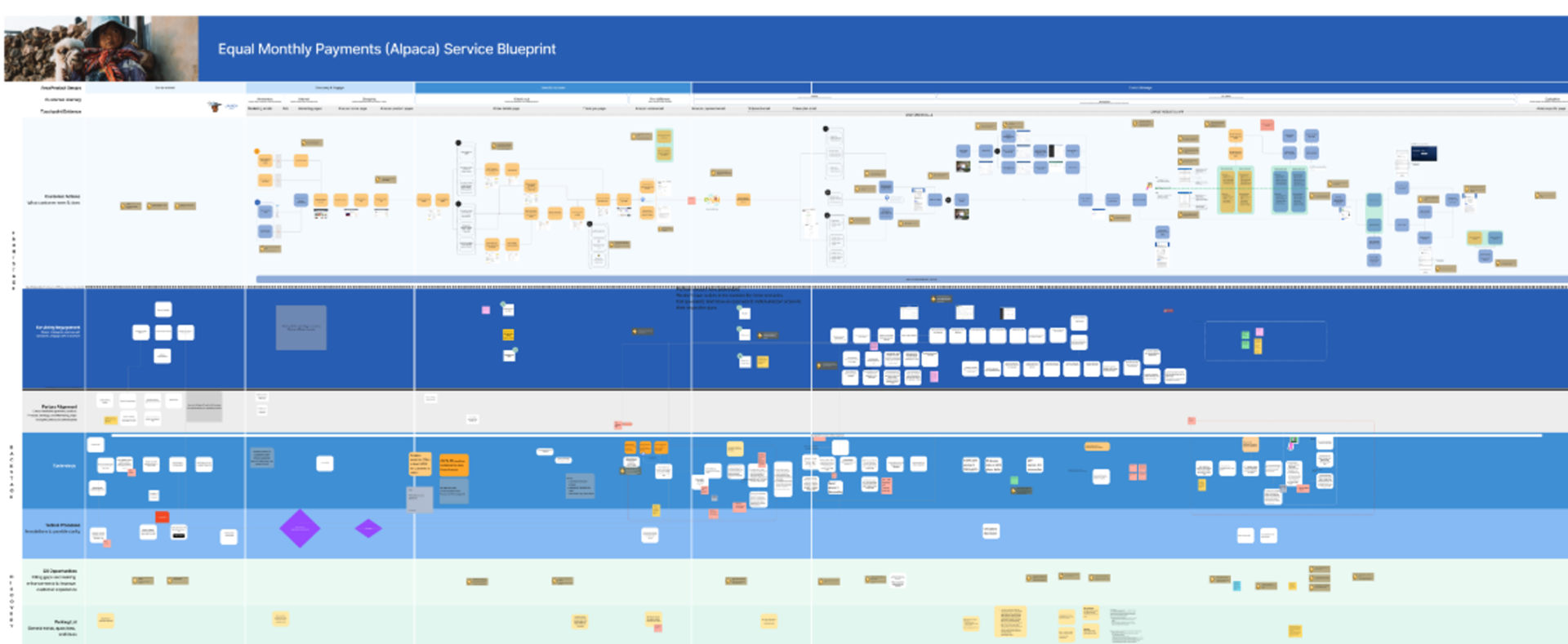

Product development is a team sport, and alignment was critical to launching the product successfully. I chose to create a service blueprint to clarify cross-functional roles in relation to the end-to-end experience.

To inform my strategy, I first met one-on-one with functional leaders to understand their goals, constraints, and connection to the overall journey. These conversations built trust and uncovered valuable insights that helped plan and frame the big picture.

Building on that foundation, I facilitated recurring working sessions with domain experts across product, technology, operations, and customer service. By using creative facilitation techniques that encouraged psychological safety and open knowledge-sharing, I uncovered invaluable insights. These helped me map each domain’s end-to-end processes, identify cross-functional dependencies, and connect internal workflows to the front-end customer experience.

Disconnected transition between platforms fragmented experience

Through the service blueprint activity, we uncovered a key experience gap: customers set up their payment plan while shopping on Amazon but manage it on Chase only after their order ships. That delay could range from hours to weeks. That causes confusion and a disjointed handoff between the two platforms.

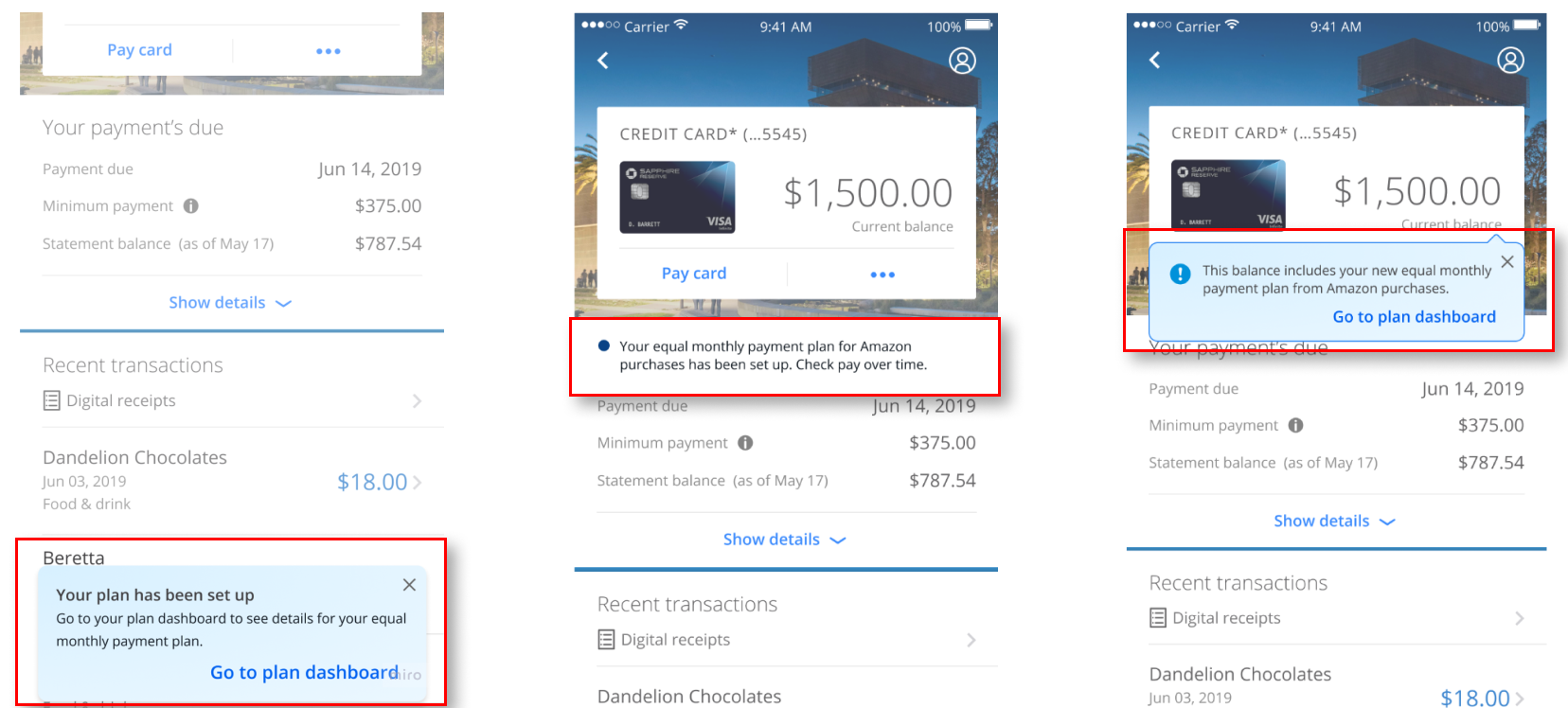

An early idea was to add an informational alert on Chase when the plan became active. However, this approach didn’t align with design system standards and lacked support from the Channels team, who oversees platform consistency. Importantly, an alert doesn't persist. Customers can miss it easily. The conversation began centering on how to implement the alert correctly. However, I recognized we were solving the wrong problem. The real issue was the disconnect between Amazon and Chase.

To refocus the team, I brought key stakeholders together for a structured workshop. I facilitated activities to build a shared understanding of the full end-to-end experience, map all use cases and entry points, including edge cases. With clarity on the actual problem, we co-ideated and refined solutions.

The new product had a disjointed experience because customers set up their plan on Amazon but could only manage it on Chase after their order ships. While early solutions focused on adding an informational alert, I recognized the real issue was a disconnected platform handoff. To reset, I led a structured workshop with key stakeholders to clarify the problem and co-create solutions.

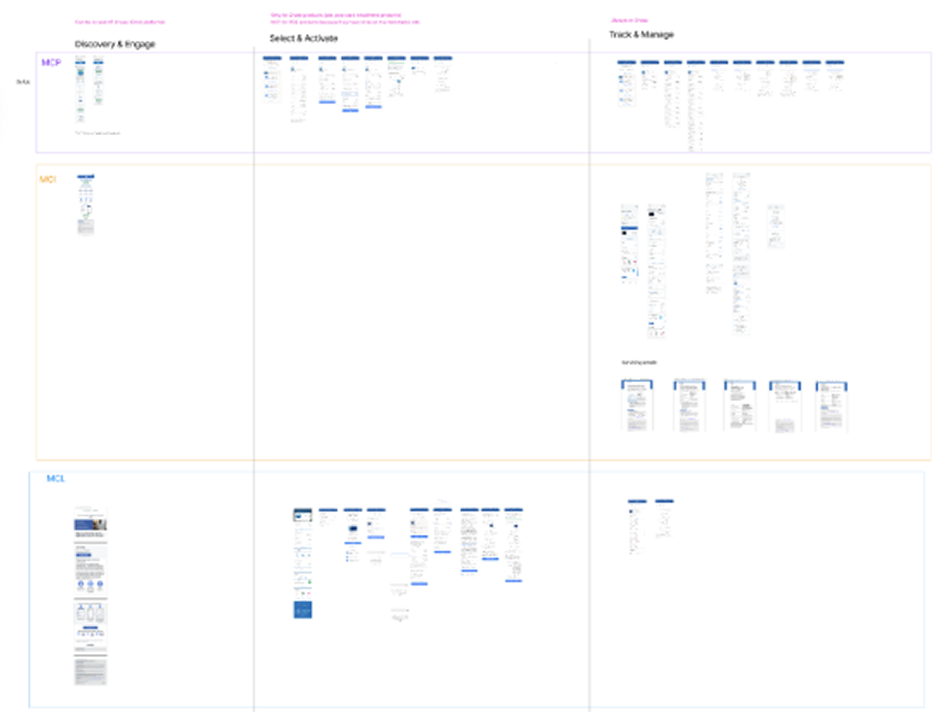

Unorganized product suite confused customers

Before launching Amazon Pay with Chase, the bank already offered two BNPL products, My Chase Plan and My Chase Loan. Amazon Pay with Chase added a third. This addition introduced a critical question: How do these products fit together?

We hadn’t clearly defined how to position each product or communicate their distinct value. This posed a risk of customer confusion, brand inconsistency, and ultimately, lower adoption.

To address this, I partnered with content designers to conduct a content audit across all three products and market analysis. This revealed key overlaps, inconsistencies, and gaps in messaging. The insights helped us set the stage for a more cohesive product narrative.

Next, I designed and led a two-day cross-functional hackathon-style workshop to align on the problem and co-create a solution. I strategically structured the sessions to keep momentum high. I delegated roles, facilitated targeted activities, and ensured all voices were heard. Participants ranged from junior designers to managing directors, spanning design, marketing, product, and legal. Together, we explored solutions grounded in our tech stack, brand strategy, and regulatory requirements — ensuring what we built was aligned, clear, and scalable across the product suite.

Amazon Pay with Chase added a third offering to the product suite. I led efforts to clarify how all offerings fit together to avoid customer confusion and brand inconsistency. I partnered with content designers on a messaging audit across products, uncovering key gaps and overlaps. To align stakeholders and drive a cohesive narrative, I designed and facilitated a two-day cross-functional workshop, uniting voices from product, tech, marketing, and legal.

💡

Delivery

Driving shared understanding and purpose to clear the path for launch

I created a service blueprint to visualize and align internal operations with the end-to-end customer journey. It mapped how teams connected across domains, documented inefficiencies and experience gaps, and highlighted key dependencies. By clarifying each group’s role in the broader ecosystem, the blueprint helped everyone see both the forest and the trees. Most importantly, it created a shared understanding of the critical challenges we needed to solve to ensure a successful launch.

To activate that shared understanding, I designed and facilitated a full-day workshop for the broader product organization. Nearly 50 cross-functional partners, from product and servicing to LRCC and marketing, came together to actively analyze the customer journey, domain workflows, dependencies, and experience gaps. The workshop transformed the blueprint from a static artifact into a collaborative, lived experience. It aligned the team on goals, clarified priorities, and energized collaboration around a unified vision. Beyond tangible outcomes, it strengthened cross-functional relationships and built momentum critical for a successful launch.

I created a service blueprint to align internal operations with the customer journey, surfacing key dependencies and experience gaps. To bring it to life, I led a full-day workshop with 50 cross-functional partners, turning the blueprint into a shared, lived experience that clarified priorities, strengthened collaboration, and built momentum for a successful launch.

Bridging the gap between Amazon and Chase

I brought key stakeholders together to reframe the challenge and co-create solutions. Instead of focusing narrowly on how to implement an informational alert, we shifted to solving the core challenge: how to develop a seamless transition for customers moving from Amazon to Chase to manage their payment plans.

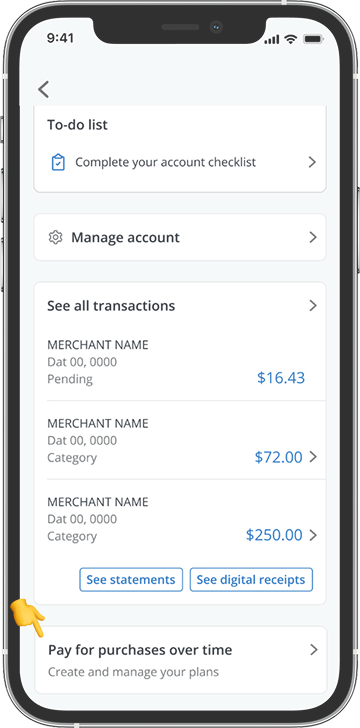

Through journey mapping, collaborative ideation, and iterative exploration, we aligned on a persistent entry point on the Chase homepage for customers with active plans. Because decision makers were part of the process from the start, the solution came with built-in buy-in and required no additional alignment, enabling smooth implementation. Additionally, the solution was scalable. It became the unified entry point for the other two BNPL offerings, streamlining the experience across three products.

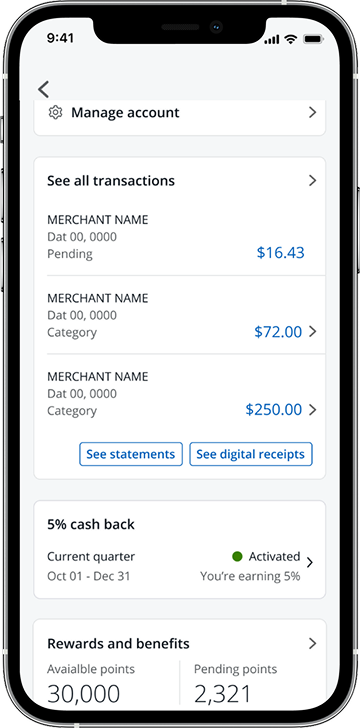

Before

Customers relied on hard-to-find links buried in top navigation or fleeting alerts tied to transactions to access and manage their plans.

After

I designed a prominent, easy-to-find, and permanent entry on the homepage that also became the launchpad for the entire product suite.

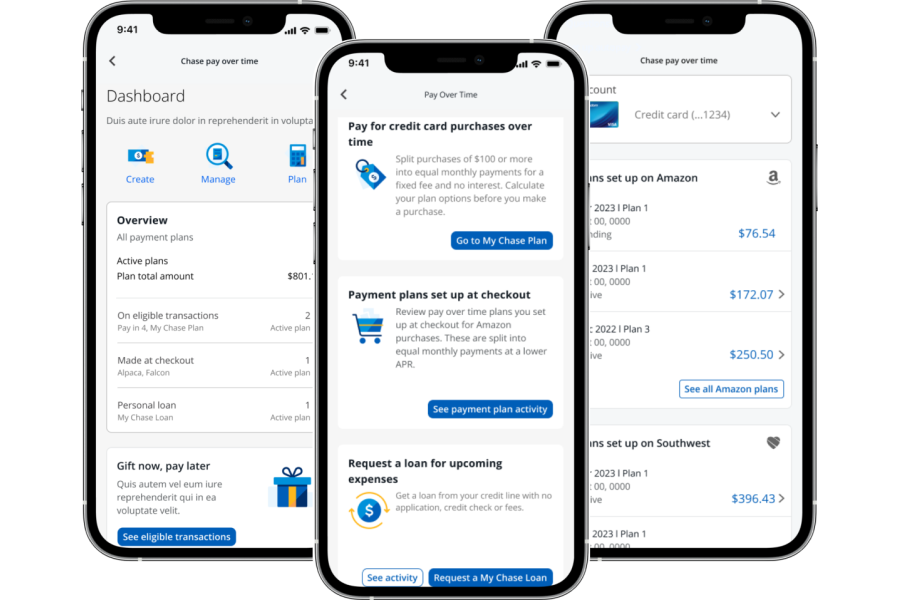

Simplifying the product suite with a narrative

Our content audit and market analysis revealed two key insight. First, customers use the three BNPL products at different stages of the shopping journey: before, during, and after purchase. Second, they rarely refer to the offerings by their official product names, instead thinking about them in terms of purpose and intent.

These findings led us to rethink both the structure and messaging of the product suite. To better reflect how customers naturally interact with our products, I restructured the three products into a clear, linear narrative and replaced product names with headline-style messaging focused on customer intent.

I bolstered this shift with a modern, streamlined, and engaging UI. Despite the significant redesign, implementation was low effort because I reused existing links, stayed within our current tech stack, and relied exclusively on components from the design system.

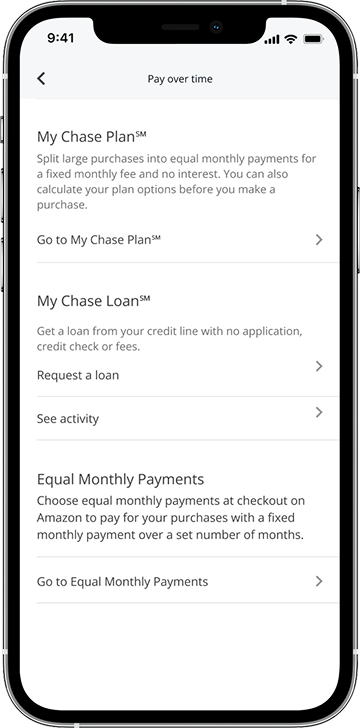

Before

Dashboard lacked clarity and engagement. It looked outdated and had unclear calls to action and product names that didn’t resonate with customers. The presentation of the offerings had no flow tied to the shopping journey.

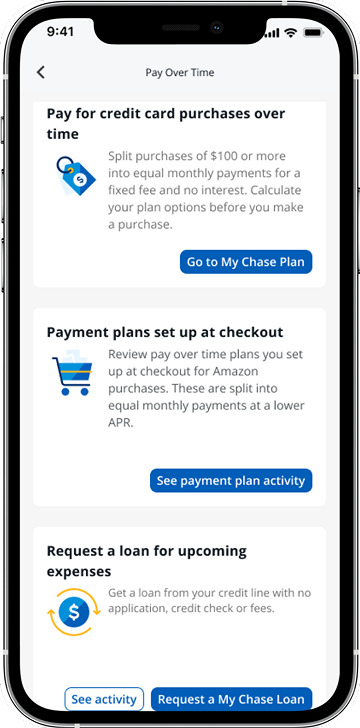

After

Redesigned dashboard has a modern UI with clear CTAs and a product presentation tied to the shopping journey. Headline-style messaging replaces product names, making it easier for customers to understand what to use, when, and why.

Results

Chase set out to expand its presence in the buy-now-pay-later space. I’m grateful and proud to have played a key role in making that vision a reality. Here’s the impact I made.

🎯

I helped bring Amazon Pay with Chase to market—expanding Chase’s footprint in the competitive buy-now-pay-later (BNPL) space. This launch was critical to the company’s goal of acquiring new customers and deepening relationships with at least 20 million people who have the Chase Amazon Visa Card, driving more than $800 million in revenue.

😃

I ensured customers can easily find and manage their payment plans—driving adoption and repeat usage for the new product. I also helped scale the product suite. New narrative tied to the shopping journey, redesigned modern dashboard, and messaging focused on customer intent made it easier for them to understand what to use, when, and why.

🏦

I helped Chase save an estimated $4 million because folding the new product into the existing suite instead of building a standalone product eliminated the need for entirely new terms and conditions. This reduced legal, compliance, and operational overhead costs.

🧠

I elevated the role of design. Through service blueprinting, collaborative workshops, and cross-functional alignment, I demonstrated how design could bring clarity to complex problems and accelerate execution. Design became essential to product and business success.

Other works

Chase Pay Over TimeOptimizing the experience of using flexible payment options at every shopping stage to drive business growth

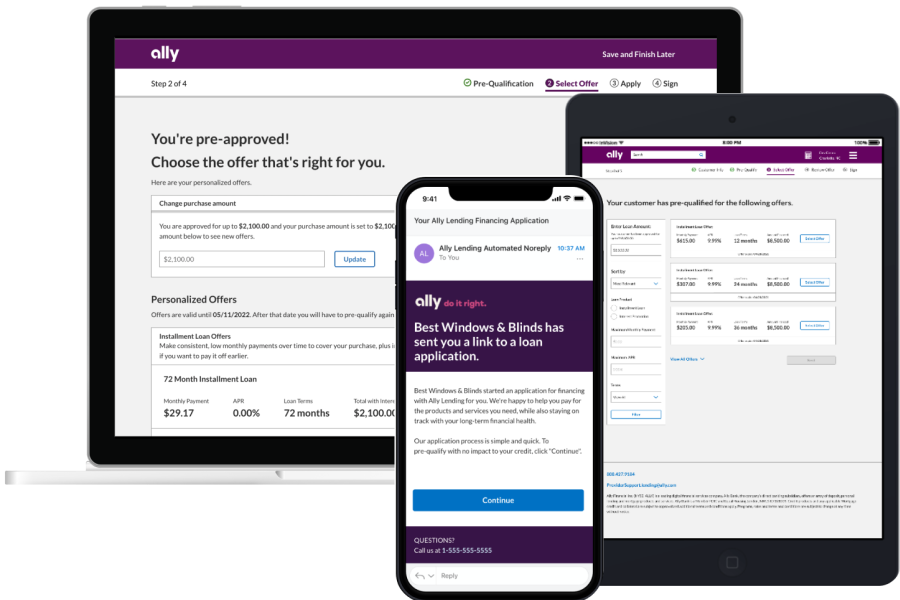

Ally LendingTo become a market leader, lender must have a loan application that satisfies merchants, consumers, and regulators

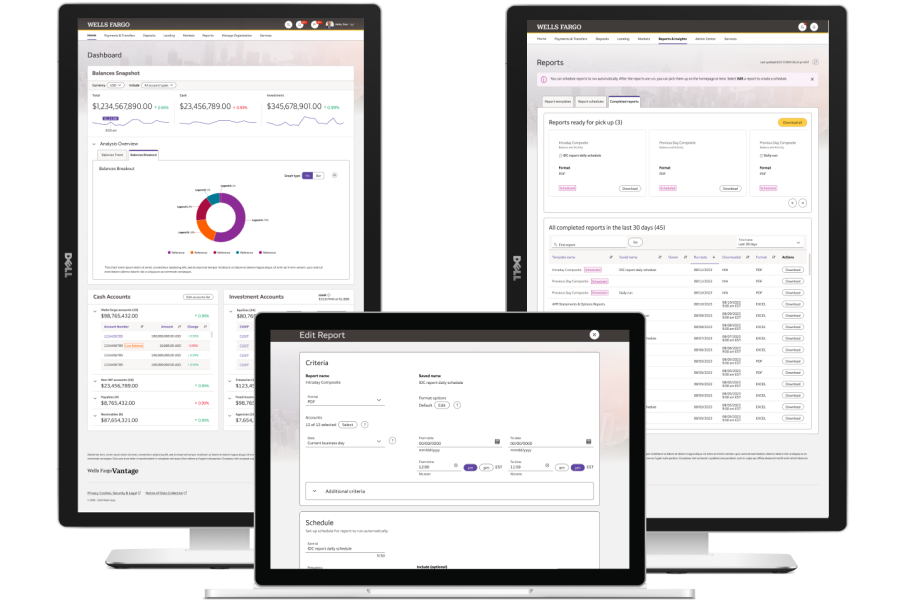

Wells Fargo VantageNew platform modernizes banking for 2 million Commercial, Corporate, and Investment Banking clients

The works presented here are for illustration purposes only. Views expressed are my own.

© Copyright 2024 - 2025