Balance Act by Design: A Lending Experience Where Borrowers, Merchants, and Regulators All Win

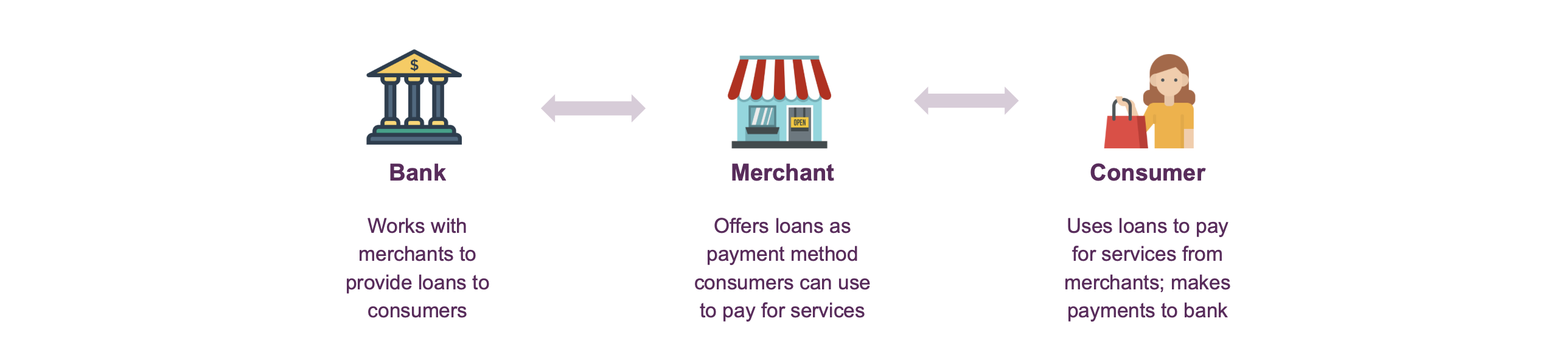

Ally Lending was the lending unit of Ally Financial. It worked with more than 28,000 merchants to offer point-of-sale loans to more than 1 million consumers, who are customers of the merchants or businesses. It's a business-to-business-to-consumer (B2B2C) model. Synchrony acquired Ally Lending in January 2024.

In this business model, merchants and consumers can have competing needs that I must balance in my design solutions. For example, the merchant wants to drive the application and to have the consumer complete the application on the merchant's tablet. However, the consumer prefers to take their time and do the application on their device.

Challenge

Ally Lending worked with merchants in diverse industries from elective medical healthcare to home improvement. These businesses have unique needs based on their industry, business model, company culture, and customer demographics. Additionally, the lender must comply with strict federal laws designed to give consumers control and transparency.

To become the most widely used lender, Ally Lending must have loans applications that work for the merchants, are easy for the consumers, and comply with regulations.

This application use case has 12 variants, which include channels like digital devices, analog telephones, and paper. It has this many variants because the consumers, merchants, and regulations have different conflicting needs. For example, many consumers don't have Internet on their devices while shopping at the merchants' businesses. They also don't use emails. For these consumers, the merchant wants the consumer to start and finish the application on the merchant's electronic device like a tablet. This is almost impossible because the E-Sign Act requires the merchant to definitively validate the consumer's signature on electronic devices.

Solution

I created multiple application experiences that are customer-centric and compliant. To ensure the right solutions, I collaborated closely with stakeholders from Sales to Compliance and conducted thorough research with merchants and consumers. After understanding the ecosystem, I grouped the different ways people apply for Ally loans into distinct use cases and created customer-centric and compliant applications for each. Solutions included feedback from users and stakeholders.

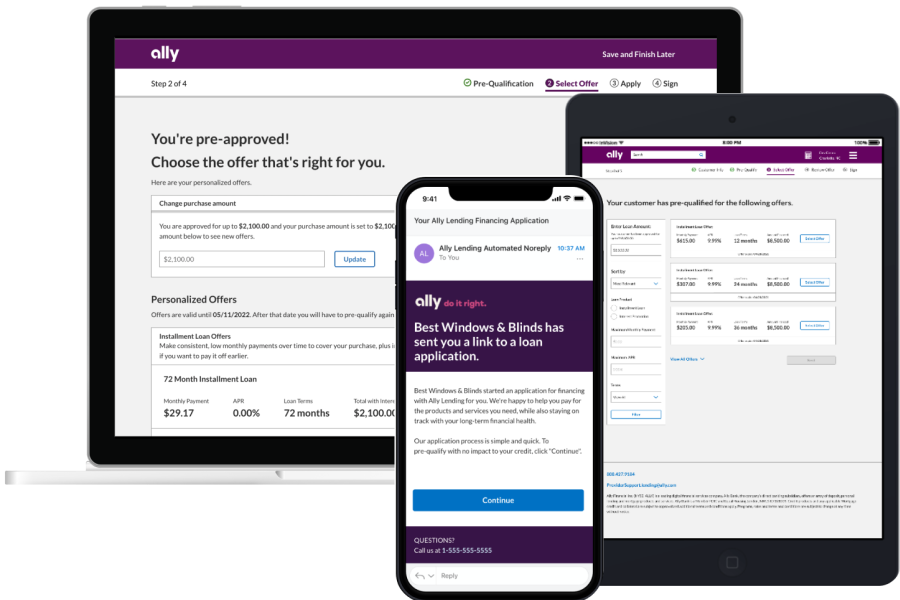

For every application use case, I considered the business priorities, environmental factors, user needs, and applicable regulations. In this self-serve application, the merchant emails the application to the consumer. The consumer validates their email when they open it and completes the application in one continuous flow. Applying best practices and user feedback through several rounds of testing, I created an application that's transparent while driving the completion rate. The application scored 93/100 on the System Usability Scale and 4.8/5 for ease of use.

My role

I practiced frameworks like Double Diamond and SAFe Agile to ensure we develop the right solutions and deliver the solutions right. I lead all design activities, including:

- Planning, executing, and socializing research such as analyzing loan activities, observing merchants and consumers, and conducting usability tests

- Sketching, wireframing, and polishing the end-to-end application experiences, which I regularly presented to leaders and stakeholders

- Creating and executing large workshops with external and internal stakeholders to foster collaboration, validate requirements, and gain buy-in

- Representing design in strategic meetings to influence and inform product priorities

- Partnering with Product and Engineer to ensure quality product development and delivery

I made it easy for merchants to offer Ally loans and for consumers to apply for them. This helped the company achieve a record $1.2 billion in funded loans at that time. Read more about my design activities below.

Design process

Discover

I conducted both quantitative and qualitative research. For example, I gathered data from Power BI and analytics teams to analyze loan activities and interviewed all user groups to quantify and qualify opportunities, respectively. Loan activities showed how many people experience this problem. Insights from the interview revealed reasons for the experience gaps and identified the user goals.

Define

I developed a holistic view of the problems that all user groups experience during the application process. Grounded in research insights, I made recommendations on the priority of experience gaps and the benefits of their solutions. I regularly presented my recommendations to leaders and partners, which informed company goals and strategies.

Using insights from ethnographic studies and interviews with users and stakeholders, I created this customer journey map to visualize the end-to-end experience of applying for an Ally loan. It includes experience gaps and improvement opportunities. This design artifact helped leaders and partners get aligned on the problem space and priorities.

Develop

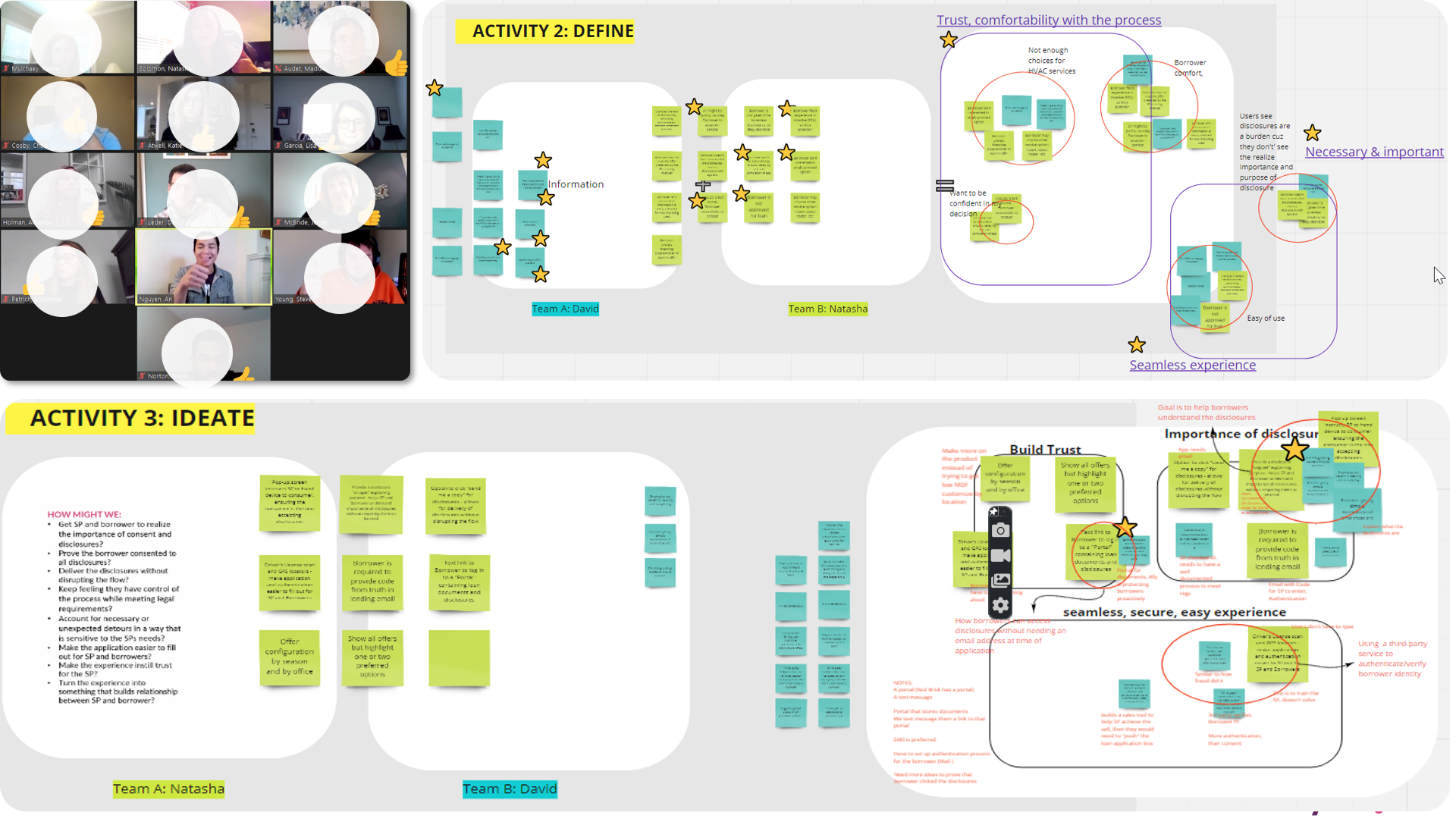

To ensure my solutions balanced desirability, feasibility, and viability, I conducted large workshops with merchants, consumers, and stakeholders. I fostered an inclusive environment that encouraged collaboration and participation from the workshop participants. This dissected the problems from many angles and generated many innovative ideas.

Testing is non-negotiable. I also planned and executed all testing with internal and external users. Depending on the objective, those tests were one-on-ones, in large groups, and on UserTesting for scale.

I planned and executed large workshops with external and internal audiences. These sessions brought people from users to Compliance together to empathize with each other, align on the problems, level-set goals, and collaborate to generate solutions.

Deliver

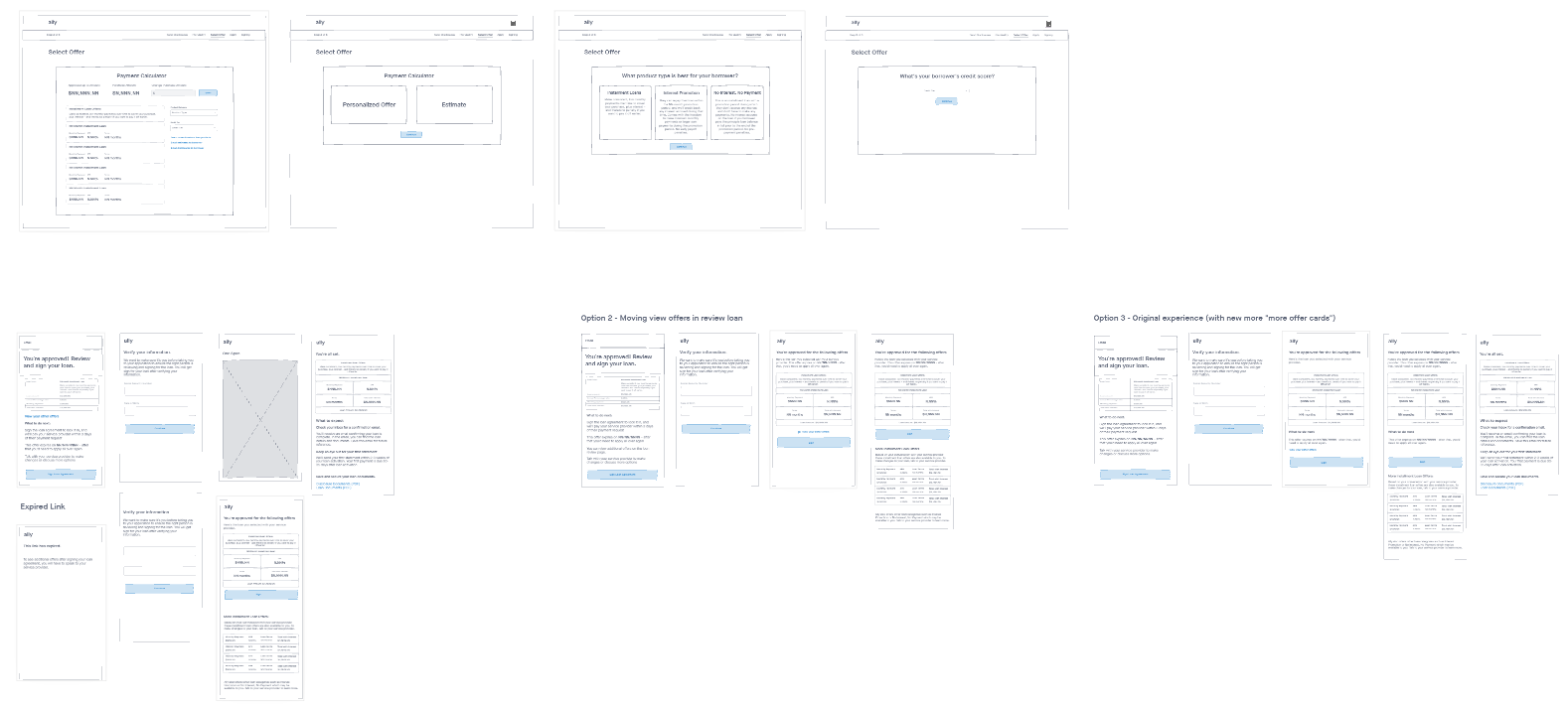

I got the solutions over the finish line. I used many design tools like InVision, Miro, Figma, Sketch, and Adobe Creative Cloud to sketch and wireframe solutions. I partnered closely with content strategists and visual designers to bring these solutions to higher fidelities for delivery and create interactive prototypes for testing.

I oversaw design from low fidelity for testing to high fidelity for delivery.

Product demo

Play the video to watch Ally Lending's first self-serve point-of-sale loan application that scored 93/100 on the System Usability Scale and 4.8/5 for ease of use.

Beyond design

While at Ally Lending, I mastered my design craft. In addition, the complexity and scope of the role allowed me to grow as a leader. My other responsibilities included:

- Build and deepen relationships across the organization to create advocates for my proposed solutions and improve collaboration in delivering the solutions

- Present research insights and design decisions impactfully to leaders and stakeholders to advocate for the consumers, drive results, and chart a North Star for the application experience

- Manage programs with large scopes and stay comfortable with changes like shifting business priorities and new regulations

- Improve design processes like organizing workflows and getting new tools, and contribute best practices for documenting design decisions and writing research guides

- Coach junior teammates to meet their project and development goals

Other works

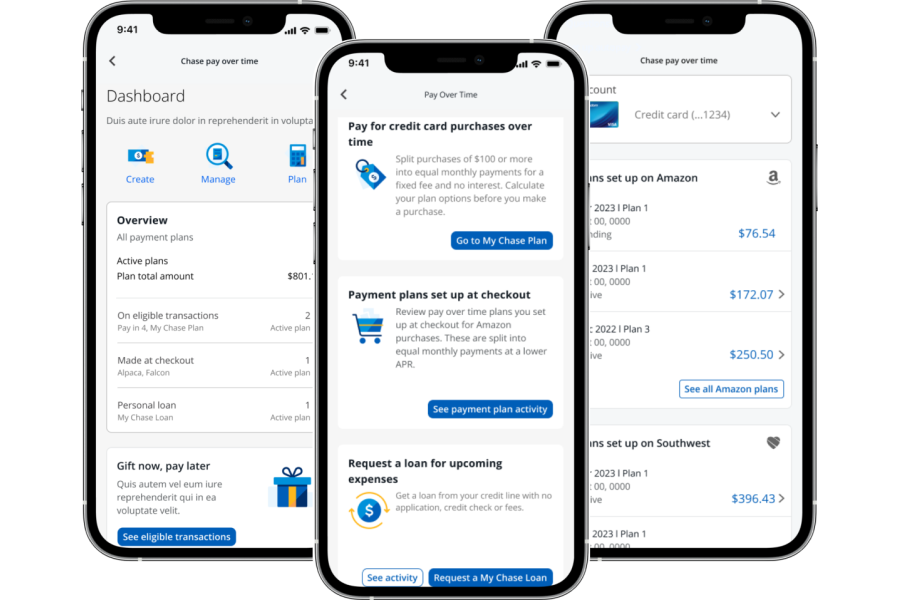

Chase Pay Over TimeOptimizing the experience of using flexible payment options at every shopping stage to drive business growth

Ally LendingTo become a market leader, lender must have a loan application that satisfies merchants, consumers, and regulators

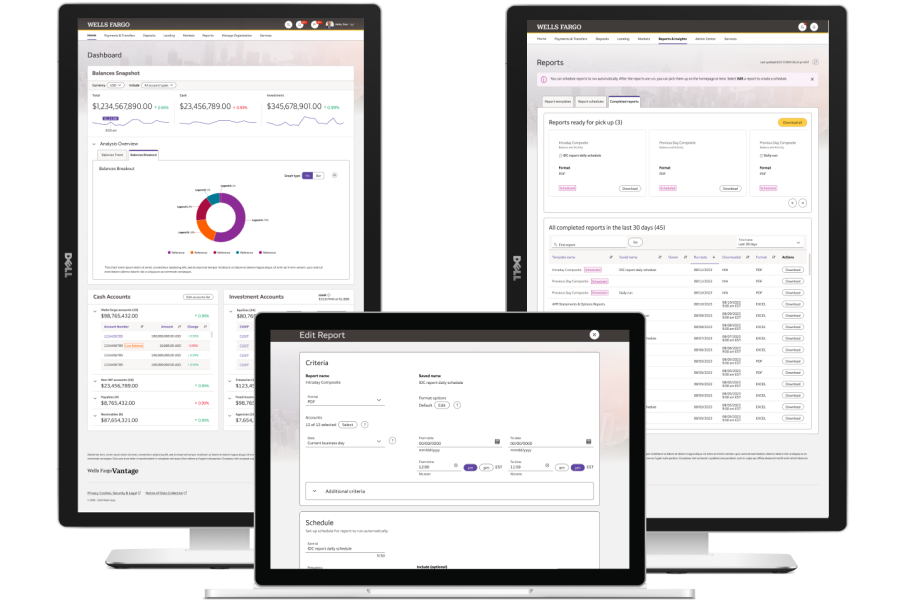

Wells Fargo VantageNew platform modernizes banking for 2 million Commercial, Corporate, and Investment Banking clients

The works presented here are for illustration purposes only. Views expressed are my own.

© Copyright 2024 - 2025